Upstart seems to be over and above your credit score history to such things as your schooling and profession route When thinking about you for the mortgage. Find out about equivalent on-line lenders.

Use a balance transfer card. Look for presents on your own current charge cards or make an application for a card that has a 0% introductory charge on balance transfers. There's a transfer charge (usually three% to 5%), nonetheless it’s possibly below you’re paying out in interest.

May be less costly than an overdraft rate: In the event your preference is between a paycheck advance and paying out an overdraft charge, the advance is probably going much less expensive. Quite a few app expenses could be less than $10 (with no idea), even though financial institution overdraft charges may be as many as $35.

May well cause an overdraft price: Most applications need use of your banking account to withdraw cash when it’s because of. Some providers say they try in order to avoid triggering an overdraft but don’t assurance it. The exception is Empower, which will refund, upon request, overdraft charges it brings about.

More points are awarded to apps that offer pathways to budgeting and saving, which might be options that will help stop a person from habitually reborrowing. We weigh these things dependant on our evaluation of which might be A very powerful for people And the way they influence individuals’ encounters.

With LendUp you can find a $2500 own installment financial loan from a immediate lender with regular monthly payments even In case you have a bad credit history score or no credit history. Make an application for a $2500 loan on the net with no stringent credit rating checks and get fast selection and quickly money deposit.

The utmost allowable rating for cash advance apps that we critique is 4 stars. Our star rankings award points to cash advance apps which provide purchaser-friendly features, together with: caps on voluntary tips, protections from overdraft expenses because of application withdrawals, affordable of borrowing and an evaluation on the person’s funds prior to offering an advance. The process also rewards factors for characteristics that a client trying to find an advance would obtain practical, which include: speedy funding and not using a payment, permitting users to borrow fewer than they had been accredited for and customer rankings.

Check out a lot more particular loan resourcesPre-qualify for a private loanCompare best lendersPersonal loan reviewsPersonal financial loan calculatorHow to qualifyHow to consolidate bank card debtAverage private loan interest charges

Employer-centered advances could demand expenses, Nevertheless they are generally reduce than cash advance app expenses and companies might cover them. click here Gained wage access companies choose around a couple of days to deliver money, that is on par with cash advance apps.

Application necessities could also vary by place, but usually, you might have the following to use:

Brief and straightforward Course of action: Our financial loan-matching provider is created with all your benefit in mind. The application process is speedy, effortless and might be completed on the web.

Evaluating financial loans is an efficient strategy to locate the most effective $two,five hundred personal mortgage supply. With the opportunity to Assess loans without any credit score score effect, there’s all the more rationale to check presents. Most lenders tend not to do a tough credit score pull during the prequalification approach. Rather, they will do a soft credit score pull. A smooth credit history pull should not effect your credit rating rating. Having said that, to receive a mortgage approval, you'll likely should consent to a tough credit rating pull. A tough credit rating pull does effects your credit rating, but This could only be shorter-term. Taking out a loan could also effect your credit rating score negatively, but this way too need to only be small-expression.

Get the absolutely free credit history scoreYour credit history reportUnderstanding your credit history scoreUsing your creditImproving your creditProtecting your credit history

Own installment loans can be used for personal debt consolidation, dwelling advancements or any unanticipated expenditures. They generally have lower interest costs than charge cards or payday financial loans so are a favorite selection for many borrowers.

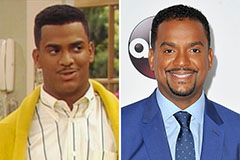

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!